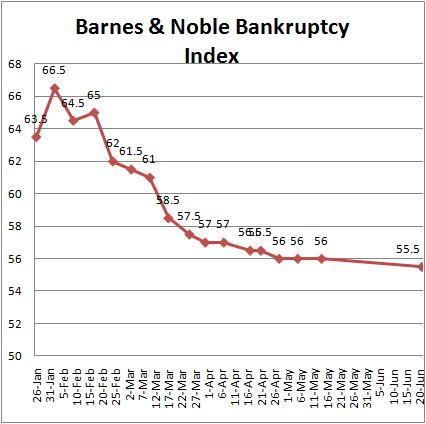

Barnes and Noble Bankruptcy Index

While Borders, the nation's second-largest book chain, has filed for bankruptcy protection and is closing about 30% of its stores nationwide, we look at Barnes & Noble, the nation's largest book chain to see if they follow will Borders and go into bankruptcy and if so, when exactly.

We follow closely the future of bookstores, both independent and big chains, as we see them as a viable part of the book industry and we also believe they can take an important part in making this industry more sustainable.

So we decided it's time to follow B&N even more closely in an effort to provide an estimate that is more than just a guestimation and is based on a number of parameters that together provide an indication on the state of B&N and how close or far they are from bankruptcy (see further updates at the bottom of the page).

Therefore we launched a B&N Bankruptcy Index that is based on 10 parameters, which receive a grade between 1-10 (1 - worst grade, 10 - best grade). This way we receive a 0-100 point index scale, which we divide into several ranges as follows:

90-100: B&N is in an excellent shape. Couldn't be better!

80-89: B&N is doing great. Bankruptcy is no longer a real threat.

70-79: B&N could do better and has to be cautious of bankruptcy.

60-69: B&N doesn't look too good and bankruptcy is becoming a more realistic threat.

50-59: Bankruptcy is a clear and present danger.

49 and less: Red alert! Bankruptcy is just around the corner and is likely to happen within a short time frame.

We will check the B&N Bankruptcy Index every week, update each one of the parameters included in the index and analyze the trend. Below you can find the description of the various parameters, a table with a summary of the weekly grades and links to our weekly posts, where you can find further details on the grade of each parameter and analysis on the situation at B&N.

Here are the 10 parameters:

1. Confidence of the stock market in B&N

This parameter will look at the performance of the B&N stock (symbol: BKS) in the last week. The performance of B&N's stock is an indication of the confidence the market has in the ability of B&N to maintain a viable business.

2. What analysts say on B&N

This parameter is looking for analysis and comments of analysts following B&N. 3. New strategy to regain sales in the brick and mortar stores

Just like Borders, B&N still doesn't have a a clear and comprehensive strategy that will transform their brick and mortar stores from a liability back to an asset. This parameter is looking for and analyzing any changes in B&N's strategy.

4. What B&N is saying about itself

This parameter will examine quotes and statements from B&N on its financial state, strategy and other related issues.

5. Steps B&N is taking

What B&N is doing to improve its situation?

6. Competitors

This parameter will mainly look into Borders and how its problems affect B&N.

7. Financial strength

This parameter is following new B&N's finanical data.

8. Strength of the digital business

Here we follow news on the digital business side of B&N's operations, including the Nook, ebooks sales and BN.com's performance.

9. Sense of urgency

This parameter will try to look into B&N's sense of urgency.

10. General feeling

This parameter will be an indication of our impression of all the materials read and analyzed for this index.

Week 1 - January 26, 2011: The best place to learn if and when B&N is going out of business

Week 2 - February 2, 2011: Is B&N also going out of business?

Week 3 - February 9, 2011: The failure of Groupon's special coupon deal

Week 4 - February 17, 2011: Will B&N follow Borders?

Week 5 - February 24, 2011: B&N's shares are going down by more than 20 percent this week

Week 6 - March 3, 2011: The stock's price continues to go down

Week 7 - March 10, 2011: No one seems to be interested in buying B&N

Week 8 - March 17, 2011: B&N stock falls below $10 this week and hits a new low

Week 9 - March 25, 2011: B&N is so cheap and yet no one wants to buy it!

Week 10 - March 31, 2011: The stock is finally going up but B&N continues to go down

Week 11 - April 7, 2011: No news this week (Only plans for Android Apps on Nook..)

Week 12 - April 17, 2011: B&N has no reply to the new $114 Kindle

Week 13 - April 21, 2011: B&N stock is rising, but no one really knows why

Week 14 - April 28, 2011: The Nook Color has new features and apps, but what about the stores?

Week 15 - May 5, 2011: B&N has plans for a new e-book reader, but apparently not for the stores

Week 16 - May 14, 2011: Borders may have a buyer while B&N put all their eggs in one e-nest

Week 17 - May 20, 2011: 5 questions to John Malone who is looking to buy Barnes & Noble for $1 billion in cash

Week 18 - June 21, 2011: Bankruptcy Index: Will John Malone still be interested in B&N following their 4Q loss?

The Index

The last 6 updates:

| |

17-Apr |

21-Apr |

28-Apr |

5-May |

14-May |

21-Jun |

| Confidence of the stock market in B&N |

4.5 |

5 |

4.5 |

4.5 |

5 |

5 |

| What analysts say on B&N |

5.5 |

5.5 |

5.5 |

5.5 |

5.5 |

5 |

| New strategy to regain sales in the brick and mortar stores |

4 |

4 |

3.5 |

3.5 |

3.5 |

3.5 |

| What B&N is saying about itself |

6 |

6 |

6 |

6 |

6 |

6 |

| Steps B&N is taking |

6 |

6 |

6 |

6 |

6 |

6 |

| Competitors |

5 |

5 |

5 |

5 |

5 |

5 |

| Financial strength |

7 |

7 |

7 |

7 |

6.5 |

6 |

| Strength of the digital business |

7.5 |

7 |

7.5 |

8 |

8 |

8.5 |

| Sense of urgency |

5.5 |

5.5 |

5.5 |

5.5 |

5.5 |

5.5 |

| General feeling |

5.5 |

5.5 |

5.5 |

5 |

5 |

5 |

| Index: |

56.5 |

56.5 |

56 |

56 |

56 |

55.5 |

More related articles:

How Barnes & Noble Can Save Itself From Becoming A Kodak Moment (Forbes, February 2, 2012)

Why the question now is when and not if Barnes and Noble will file for bankruptcy (Eco-Libris blog, January 29, 2012) Is Barnes & Noble Headed for Bankruptcy? (The Motley Fool, January 18, 2012)

First, Borders; Then, Kodak; Now, Barnes & Noble? (New American, January 9, 2012)

5 reasons why the Nook spin off gets B&N closer to bankruptcy (Eco-Libris blog, January 5, 2012)

How investors can profit in the event Barnes & Noble file for bankruptcy (Eco-Libris blog, December 13, 2011)

Five Reasons Amazon Fire May Kill Barnes & Noble (International Business Times, September 28, 2011)

How green is the Kindle Fire - part 3: Will it kill B&N and drive the bookseller into bankruptcy? (Eco-Libris blog, Oct 6, 2011)

You can find more resources on the future of bookstores on our website at www.ecolibris.net/bookstores_future.asp

Check also our webpage on the Future for Borders Bookstores After Bankruptcy

Back

to Eco-Libris homepage

|